Proposition 30 closes spending gap between state and nation

Source: Califorina Upkeep and Policy Center

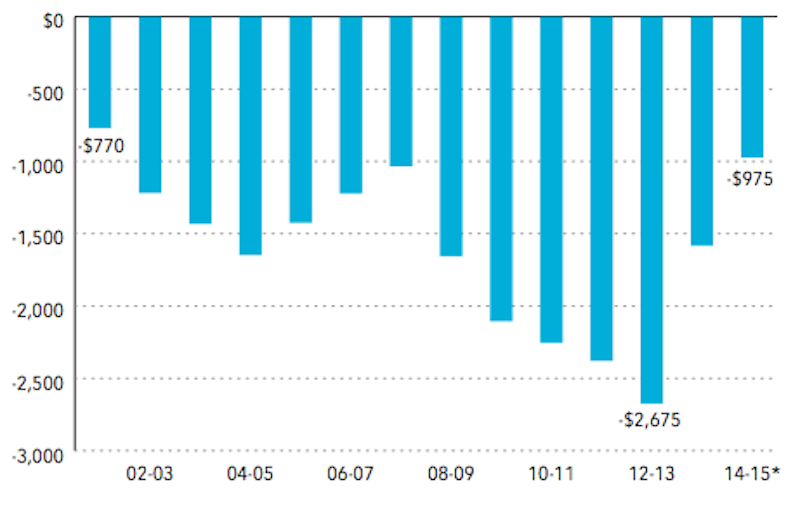

This nautical chart shows the per pupil spending gap betwixt California's Chiliad-12 schools and the national average over the past 14 years in inflation-adapted dollars. Information technology has narrowed essentially in the by two years, through revenue from Proposition xxx, but is still nearly $1,000 per educatee below average – about what information technology was in 2007-08, earlier the recession.

Source: Califorina Budget and Policy Center

Source: Califorina Budget and Policy Center

This nautical chart shows the per pupil spending gap between California'southward K-12 schools and the national boilerplate over the past 14 years in aggrandizement-adjusted dollars. Information technology has narrowed essentially in the past two years, through revenue from Suggestion 30, but is still nearly $1,000 per student below average – nearly what it was in 2007-08, before the recession.

Acquirement from temporary taxes from Proposition thirty has closed the 1000-12 spending gap between California and the national boilerplate past more than than 60 percent, according to data released Mon by the California Budget and Policy Center, a nonprofit inquiry organization.

The center is using data released last week by the National Teaching Clan, and includes estimates for 2014-15, based on twice yearly surveys of u.s.. In 2014-15, California is expected to spend $eleven,190 per educatee, including federal, state and local acquirement sources, co-ordinate to the NEA, ranking the land 29th among the 50 states and Washington, D.C. California was 42nd in spending in 2012-13, with spending of $9,013 per student.

The reason for the increase is Proffer 30, a seven-year tax increment that California voters passed in 2012. It is expected to bring in an additional $7.9 billion this yr in school funding through increases in the personal income taxes of the height wage earners and a higher sales taxation charge per unit.

In 2012-13, per-pupil spending in California was $2,675 less than the average of the 49 other states and Washington, D.C. This year, California will spend $975 less per educatee, according to the center.

While subject to revision, "this is the best snapshot nosotros have," said Jonathan Kaplan, senior policy analyst for the center.

Earlier this year, Instruction Week'southward annual ranking placed California 46thursday in per-pupil spending, compared with 50th the previous yr. Only Ed Calendar week's rankings are three years quondam, based on data collected by the National Heart for Education Statistics, and also were adapted, using wage and bacon data, to reflect regional costs of living.

Education advocates tend to cite either the NEA or Ed Week, depending on their points of view. The California Upkeep and Policy Center plans to result a comparison of the two approaches in coming weeks.

Proposition 30 is set to expire within the next three years, starting with the finish of the quarter-cent increment in the sales tax after 2015-16. At that point K-12 and customs college revenues are expected to flatten out or, in the case of a recession, refuse. The California Teachers Association and the California Schoolhouse Boards Association support an initiative for the 2022 ballot extending the tax or making it permanent. Gov. Jerry Brown then far has indicated he opposes renewing information technology.

To get more reports like this one, click here to sign up for EdSource's no-cost daily electronic mail on latest developments in education.

miesnerlegiring76.blogspot.com

Source: https://edsource.org/2015/proposition-30-closes-spending-gap-between-state-and-nation/76953

0 Response to "Proposition 30 closes spending gap between state and nation"

Post a Comment